Ways to Give

Every gift makes a difference in the lives of our patients, students and faculty.

UNC Health is committed to improving the health of North Carolinians and others around the world by educating tomorrow’s healthcare leaders, supporting innovative research and delivering quality, compassionate patient care. When you make a gift to UNC Health, you share in this commitment.

You may designate your gift for a particular purpose, department or unit, or the gift can be unrestricted for use where the needs and opportunities are the greatest.

Give Today

Mail A Check

Send checks, payable to “UNC Health Foundation” to:

UNC Health Foundation

123 West Franklin Street

Suite 510

Chapel Hill, NC 27516

Endowed Funds and Expendable / Non-endowed Funds

Your gift can create an endowed fund or an expendable, non-endowed fund. Endowed funds are permanent and self-sustaining, often used to support scholarships, professorships, and other key areas in research and education. An expendable or non-endowed fund is available for immediate use by the fund’s recipient.

Endowed funds

Through investment of the donor’s principal gift (original amount), an endowed fund allows for ongoing annual spending towards the fund’s purpose. Investment income generates yearly payouts, usually around 4.5% of the fund’s market value. Any earnings above the annual payout are used to build the fund’s value to provide permanent, long-term support for its designated purpose.

Donors create endowed funds to support and sustain many causes at UNC Health and School of Medicine. Your endowment might fund a permanent named scholarship or professorship, establish a concentrated research effort, or provide patient and family support.

Expendable gifts

A non-endowed or expendable fund is a gift that is available for immediate use. The gift is not usually invested for the long term but is used to meet a pressing priority, often in the same year the gift is received.

Expendable gifts can be for restricted use, with specific instructions established by the donor, such as jumpstarting a research effort or providing student support. Expendable gifts can also be for unrestricted use, without specific designations or instructions. For example, since 2020 we’ve used your unrestricted support to meet emerging opportunities related to COVID-19 research and health equity.

Both endowed or expendable gifts can support existing funds, or they can be used to create new funds.

Tribute gifts may be made to remember a family member, friend, or colleague who has passed away or to honor a caregiver or a loved one celebrating a special occasion (birthday, wedding). For more information on tribute gifts, visit unchealthfoundation.org/tribute-gifts.

Your support is vital to the success of UNC Health. Annual gifts provide necessary funding to respond to immediate needs and emerging challenges. These gifts allow us to fulfill our mission by providing critical funding for research, training medical professionals, pioneering novel treatments and improving health outcomes.

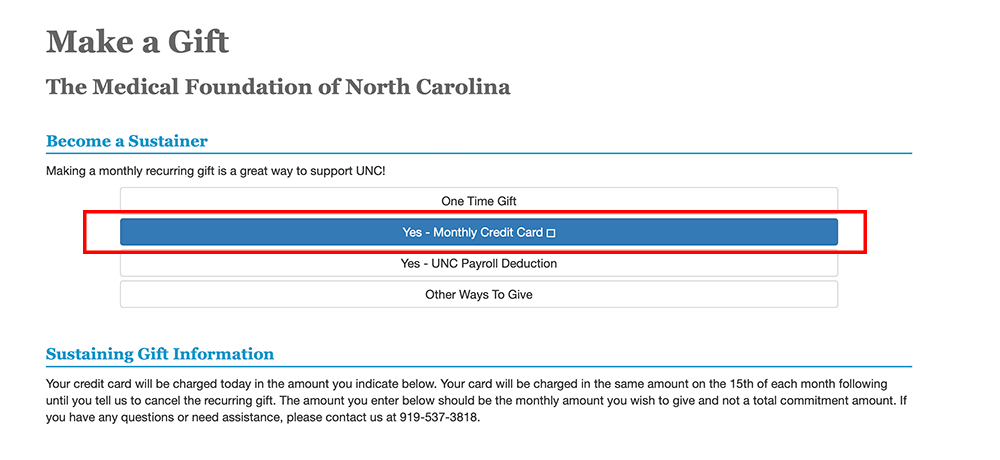

Monthly Sustainers

Looking for the best way to support our work? Become a monthly sustainer. Monthly gifts:

- provide a reliable, steady source of income—funding important work such as research, patient care, and medical education

- are secure, convenient, and easy–eliminating the need for checks

- provide flexibility to make a larger gift over time

Give Today

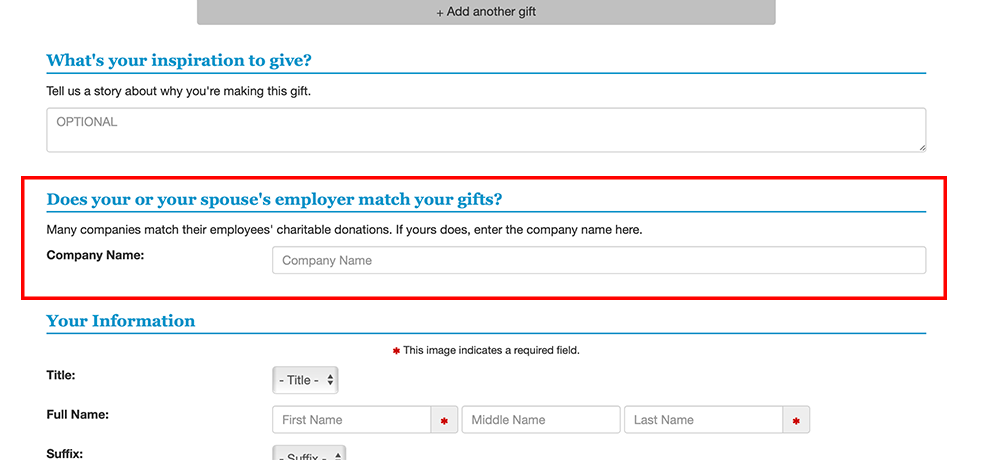

Matching Gifts

You may be able to double or even triple the impact of your donation! Many employers sponsor matching gift programs and will match any charitable contributions made by their employees, retirees and/or even the employees’ spouses. Visit matchinggifts.com/unc to see if your employer participates. Complete the information on your online giving form:

Give Today

Questions?

Please contact

Kathy J. Valley

Director of Annual Giving

UNC Health Foundation

123 W. Franklin Street, Suite 510

Chapel Hill, NC 27516

919-843-6714

kathy_valley@med.unc.edu

Our employees and retirees are the heart of UNC Health. Your support shows others in our community and beyond that you believe in the life-saving work that occurs at UNC each and every day. There is no better testimonial to the work we do than your support.

Donations can support the fund of your choice. If you wish to give through payroll deduction, please use the correct form listed below. Thank you!

UNC Health Care Employees

This form is for payroll deduction and should only be used by employees of UNC Health.

Other UNC Employees

This form is for payroll deduction and should only be used by other employees of schools and colleges at UNC-Chapel Hill.

Our employees and retirees are the heart of UNC Health. Your support shows others in our community and beyond that you believe in the life-saving work that occurs at UNC Rex each and every day. There is no better testimonial to the work we do than your support.

Donations can support the fund of your choice. If you wish to give through payroll deduction, please use the form listed below. Thank you!

UNC Rex Employees

This form is for payroll deduction and should only be used by employees of UNC Rex.

Questions?

Please contact

Kathy J. Valley

Director of Annual Giving

UNC Health Foundation

123 W. Franklin Street, Suite 510

Chapel Hill, NC 27516

919-843-6714

kathy_valley@med.unc.edu